The 2-Minute Rule for Transaction Advisory Services

Wiki Article

Transaction Advisory Services - An Overview

Table of ContentsThe Buzz on Transaction Advisory ServicesThe 9-Second Trick For Transaction Advisory Services10 Easy Facts About Transaction Advisory Services DescribedThe Transaction Advisory Services Ideas4 Simple Techniques For Transaction Advisory Services

This action makes certain business looks its finest to possible customers. Obtaining the organization's value right is important for a successful sale. Advisors utilize various techniques, like affordable cash money circulation (DCF) analysis, contrasting with similar business, and recent transactions, to find out the fair market value. This helps set a fair rate and negotiate successfully with future buyers.Deal advisors action in to aid by getting all the required details organized, addressing concerns from customers, and arranging brows through to the business's area. Transaction experts use their know-how to help business proprietors take care of challenging arrangements, satisfy purchaser assumptions, and structure deals that match the owner's goals.

Fulfilling legal guidelines is important in any kind of company sale. They assist service owners in intending for their following steps, whether it's retired life, starting a new venture, or managing their newfound wealth.

Purchase advisors bring a wide range of experience and understanding, making sure that every aspect of the sale is managed professionally. Via strategic prep work, evaluation, and arrangement, TAS assists company owner attain the greatest feasible sale rate. By ensuring lawful and regulative compliance and managing due persistance alongside various other offer employee, deal experts minimize prospective threats and responsibilities.

All about Transaction Advisory Services

By contrast, Large 4 TS teams: Service (e.g., when a prospective customer is carrying out due diligence, or when a deal is shutting and the buyer needs to integrate the business and re-value the vendor's Balance Sheet). Are with costs that are not linked to the deal shutting successfully. Gain charges per engagement somewhere in the, which is less than what financial investment financial institutions make also on "small deals" (but the collection chance is also much greater).

The interview inquiries are extremely similar to financial investment financial interview concerns, yet they'll focus more on bookkeeping and valuation and much less on topics like LBO modeling. For instance, anticipate inquiries about what the Change in Capital methods, EBIT vs. EBITDA vs. Take-home pay, and "accountant this link only" topics like test balances try this site and exactly how to go through occasions utilizing debits and credits instead of monetary statement modifications.

What Does Transaction Advisory Services Do?

Experts in the TS/ FDD groups might also talk to monitoring concerning whatever above, and they'll create a thorough record with their searchings for at the end of the process., and the general shape looks like this: The entry-level role, where you do a great deal of data and monetary evaluation (2 years for a promotion from here). The next degree up; similar job, but you get the more fascinating bits (3 years for a promo).

Particularly, it's challenging to get promoted past the Supervisor degree since few individuals leave the job at that phase, and you require to begin showing evidence of your capability to create income to advancement. Let's begin with the hours and lifestyle because those are less complicated to explain:. There are occasional late nights and weekend break job, yet absolutely nothing like the frenzied nature of financial investment financial.

There are cost-of-living modifications, so expect reduced payment if you're in a more affordable place outside major financial (Transaction Advisory Services). For all settings except Companion, the base income makes up the mass of the complete payment; the year-end reward may be a max of 30% of your base income. Commonly, the very best method to boost your profits is to change to a different her latest blog firm and discuss for a higher salary and perk

The Best Strategy To Use For Transaction Advisory Services

At this phase, you need to simply remain and make a run for a Partner-level duty. If you desire to leave, possibly move to a customer and do their evaluations and due diligence in-house.The primary problem is that due to the fact that: You usually need to join another Huge 4 group, such as audit, and job there for a couple of years and after that move right into TS, job there for a couple of years and after that relocate right into IB. And there's still no warranty of winning this IB role due to the fact that it depends on your area, clients, and the working with market at the time.

Longer-term, there is additionally some threat of and since examining a firm's historic economic information is not precisely brain surgery. Yes, human beings will constantly require to be entailed, but with even more innovative modern technology, reduced head counts might possibly sustain client involvements. That claimed, the Purchase Services group beats audit in regards to pay, job, and departure opportunities.

If you liked this article, you may be thinking about analysis.

A Biased View of Transaction Advisory Services

Develop advanced financial structures that aid in figuring out the real market worth of a company. Give advisory job in relationship to business valuation to aid in negotiating and pricing structures. Describe one of the most appropriate form of the offer and the sort of consideration to use (cash, supply, make out, and others).

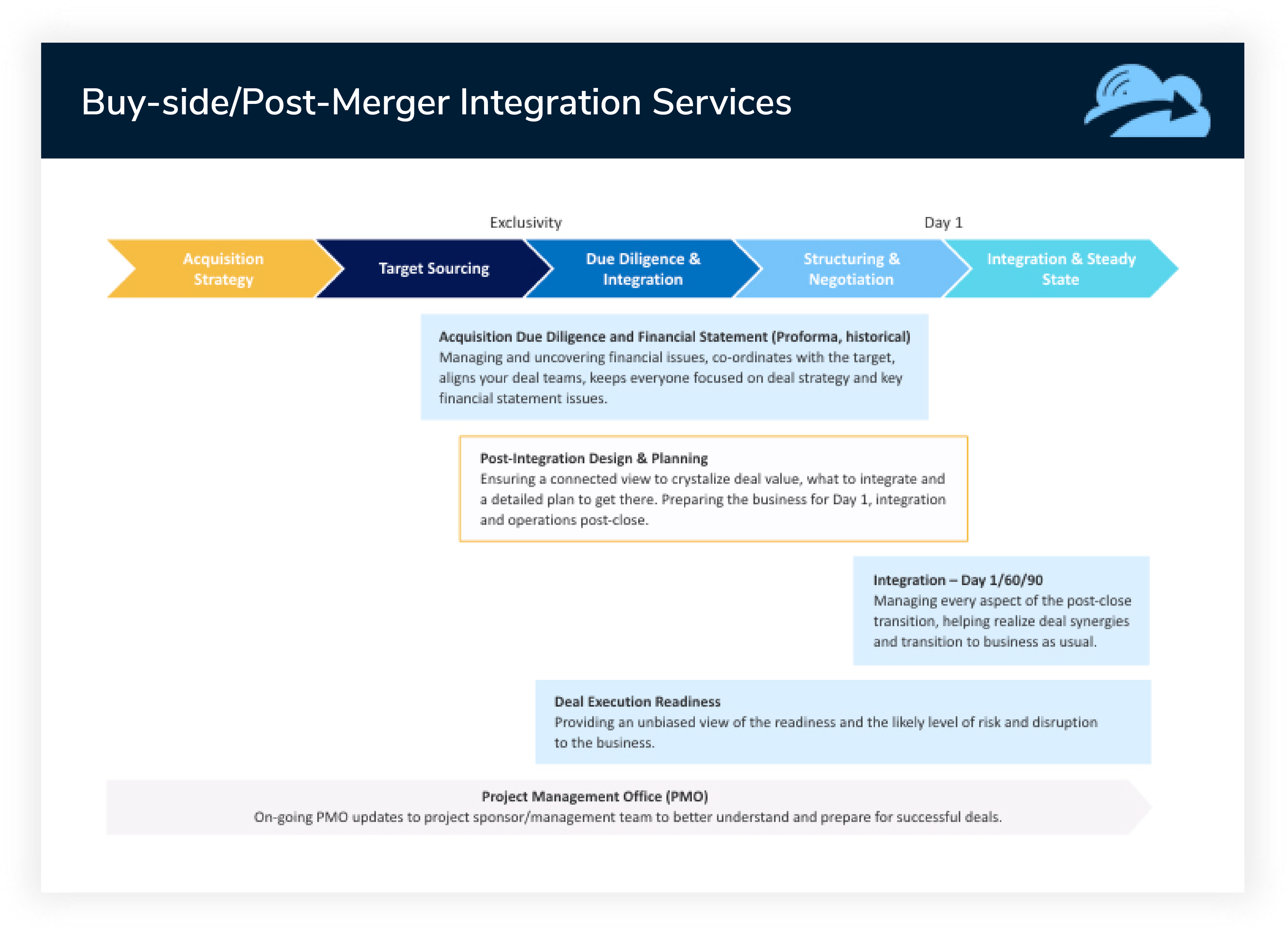

Perform assimilation preparation to figure out the procedure, system, and business adjustments that may be required after the offer. Set standards for incorporating divisions, technologies, and service procedures.

Identify prospective reductions by minimizing DPO, DIO, and DSO. Analyze the prospective consumer base, industry verticals, and sales cycle. Think about the opportunities for both cross-selling and up-selling (Transaction Advisory Services). The operational due persistance offers crucial understandings into the functioning of the firm to be obtained worrying threat analysis and value development. Recognize temporary alterations to funds, financial institutions, and systems.

Report this wiki page